Unlocking Savings: Your Ultimate Guide to Economical Auto Insurance

Navigating the landscape of automobile insurance can typically really feel frustrating, yet recognizing the crucial components can unlock considerable financial savings. Aspects such as your driving background, vehicle kind, and coverage choices play an essential function in establishing your premium costs. By tactically coming close to these aspects and comparing different providers, one can reveal considerable price cuts. Nevertheless, the process does not finish with merely picking a plan; instead, it demands continuous assessment and informed decision-making to make sure optimal security and affordability. What steps can you require to optimize your cost savings while maintaining the required protection?

Comprehending Automobile Insurance Policy Essentials

Comprehending the fundamentals of car insurance is essential for any kind of car proprietor. Vehicle insurance coverage acts as a safety step versus financial loss resulting from accidents, theft, or damage to your vehicle. It is not just a legal demand in many territories but additionally a practical financial investment to safeguard your properties and health.

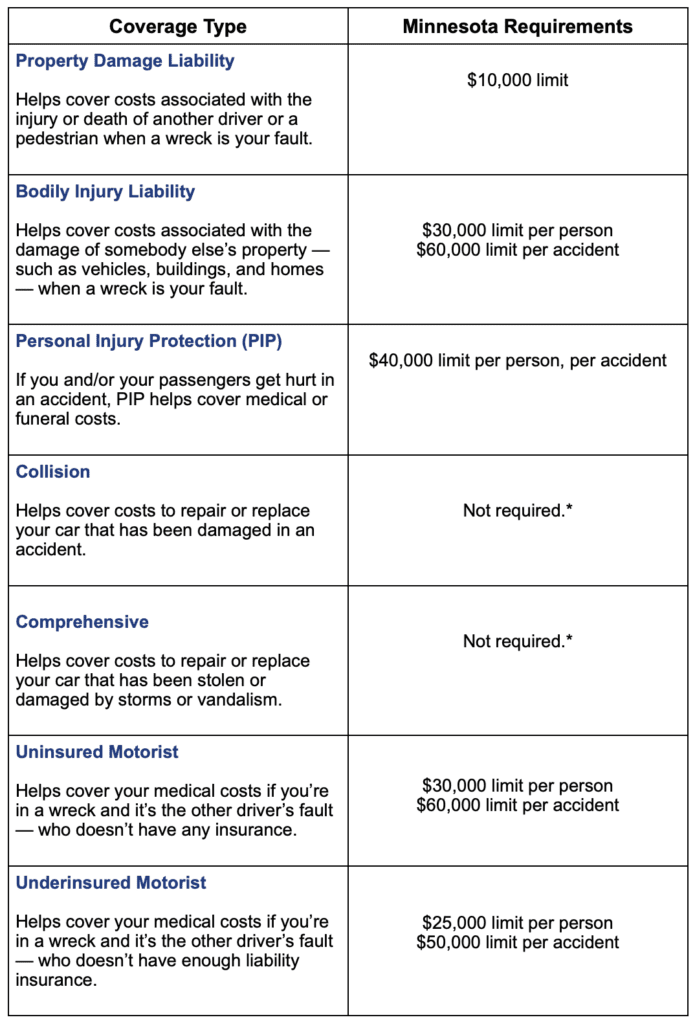

At its core, auto insurance policy typically consists of several key parts, including obligation insurance coverage, accident coverage, and thorough insurance coverage. Liability protection secures you against claims arising from injuries or problems you trigger to others in a mishap. Accident insurance coverage, on the various other hand, covers problems to your car resulting from a collision with another lorry or things, while detailed protection secures against non-collision-related occurrences, such as burglary or natural calamities.

Additionally, comprehending policy restrictions and deductibles is necessary. Plan limits figure out the optimum amount your insurance company will certainly pay in case of an insurance claim, while deductibles are the quantity you will certainly pay out-of-pocket prior to your insurance coverage begins. Acquainting yourself with these ideas can empower you to make educated choices, ensuring you select the right protection to meet your needs while maintaining cost.

Elements Affecting Costs Prices

Several elements dramatically affect the price of vehicle insurance coverage premiums, influencing the total price of protection. Among the main components is the motorist's age and driving experience, as more youthful, less seasoned drivers typically encounter higher premiums due to their increased risk profile. Additionally, the kind of vehicle insured plays an essential duty; high-performance or high-end cars frequently incur greater prices due to their repair work and substitute expenditures.

Geographical location is another essential aspect, with urban locations normally experiencing greater premiums contrasted to country regions, greatly due to boosted traffic and accident rates. The motorist's credit background and claims history can likewise affect premiums; those with a bad credit history rating or a history of constant insurance claims may be billed higher rates.

Moreover, the level of insurance coverage selected, consisting of deductibles and plan restrictions, can affect premium prices considerably. Finally, the purpose of the car, whether for personal use, commuting, or service, might also determine premium variants. When looking for budget-friendly auto insurance policy., comprehending these aspects can assist customers make notified choices (auto insurance).

Tips for Decreasing Costs

Lowering vehicle insurance coverage premiums is obtainable with a variety of critical approaches. One effective approach is to increase your deductible. By going with a higher insurance deductible, you can lower your costs, though it's vital to guarantee you can easily cover this amount in the event of a claim.

Making use of readily available discount rates can further lower costs. Numerous insurance firms use discount rates for risk-free driving, bundling policies, or having certain safety functions in your automobile. It's a good idea to ask regarding these choices.

An additional approach is to assess your credit report, as several insurer element this into costs estimations. Improving your credit history can cause much better rates.

Last but not least, take into consideration enlisting in a vehicle driver safety and security program. Completing such programs usually visit this site right here qualifies you for costs discounts, showcasing your dedication to secure driving. By implementing these approaches, you can properly lower your automobile insurance policy costs while maintaining sufficient protection.

Comparing Insurance Policy Providers

When looking for to reduced automobile insurance coverage prices, comparing insurance suppliers is a vital action in finding the most effective insurance coverage at an economical price. Each insurer supplies unique policies, coverage alternatives, and pricing frameworks, which can dramatically influence your total expenses.

To start, collect quotes from multiple providers, ensuring you preserve regular coverage levels for an exact comparison. Look beyond the premium expenses; look at the specifics of each policy, including deductibles, responsibility limits, and any type of additional functions such as roadside aid or rental cars and truck coverage. Recognizing these aspects will help you identify the value of each policy.

Furthermore, take into consideration the credibility and consumer service of each provider. Research study on-line evaluations and scores to evaluate consumer complete satisfaction and claims-handling effectiveness. A copyright with a strong track document in solution might deserve a somewhat greater costs.

When to Reassess Your Plan

Routinely reassessing your automobile insurance plan is critical for making certain that you are getting the best coverage for your requirements and budget - auto insurance. In addition, obtaining a new car or offering one can change your insurance coverage demands.

Changes in your driving behaviors, such as a new task with a much longer commute, ought to additionally prompt a review. Considerable life events, consisting of marriage or the birth of a youngster, may require additional insurance coverage or modifications to existing policies.

Final Thought

Attaining savings on automobile insurance demands an extensive understanding of coverage requirements and premium influencing aspects. Through diligent comparison of quotes, analysis of driving documents, and examination of vehicle security attributes, people can uncover possible price cuts. Furthermore, approaches such as enhancing deductibles and regularly evaluating policies contribute to reduce costs. Remaining educated and positive in reviewing choices inevitably ensures access to budget friendly auto insurance while keeping enough defense for possessions.

At its core, automobile insurance coverage typically is composed of numerous essential parts, consisting of responsibility insurance coverage, accident insurance coverage, and thorough insurance coverage.Several factors dramatically influence the cost of auto insurance coverage premiums, impacting the this article general affordability of protection. By implementing these techniques, you can effectively lower your automobile insurance policy costs while maintaining adequate coverage.

Routinely reassessing your vehicle insurance coverage policy is vital for making certain that you are obtaining the finest insurance coverage for your requirements and budget plan.Attaining cost savings on vehicle insurance requires a comprehensive understanding of insurance coverage requirements and premium influencing factors.